How to get your social security number in Italy – Fiscal Code and why you need one

What is a codice fiscale / Italian social security number and how to get one?

Can you reside with codice fiscale in Italy? During your stay in Rome, Milan, Naples, Bologna, Turin, Palermo or Florence, you will probably have to get a Codice Fiscale. An Italian tax code is like a social security number, but you need to have one in many cases, even though you are not be subject to Italian taxes. Having an Italian Codice Fiscale is mandatory for many activities. The process to obtain your Italian social security number is not difficult, however, for those who are not familiar with Italian bureaucracy, the procedure can be a little tricky. The quickest and easiest way is to obtain the fiscal code through a service like this.

Fiscal code in Italy is needed for those activities

- A) opening a bank or postal account

- B) buying a Vespa (and every other motor vehicle..) in Italy

- C) registering a vehicle in Italy

- D) signing a lease for a flat (if the lease is going to be registered)

- E) when taxing out an Italian Insurance policy

- F) to take up employment of any kind (whether internship or paid)

- G) to sign contracts with utility companies (gas, electricity, water, internet, phones, mobile phones, etc.)

Fiscal Code in Italy: how to get your Codice Fiscale

Do you want to know how to get an Italian fiscal code? Bring your Passportor National identity card to the provincial tax office in your city.

Ask for a Codice Fiscale form and take a number from the front desk.

Fill out the form (personal and address information). The form is all in Italian so bring an Italian dictionary!

When your number is called on screen, go to the sportello (window) displayed and give them your form.

If you are a free rider, the whole operation of getting your Italian Codice Fiscale could become a mess. The bureaucracy in Italy is something complex and you need to familiarize with the documents and forms before going to the offices. As an alternative, you can rely on the service offered by Italylawfirms, a trusted agency who can take in charge of the whole operation.

What does tax code mean in Italy?

Italian tax code does not imply any tax duty per se, it is an Italian identification code – some functions are in common with the social security number that many other countries have.

Codice fiscale: what is it?

Codice fiscale is the Italian Tax Identification number which identifies a Tax Payer for the local Tax Authorities. This Italian Tax Code is formed by some letters of the name of the person and all his/her data (date and place of birth). Obtaining the Italian codice fiscale with the Italian fiscal code card does not mean that you become automatically an “Italian Tax Payer” but, as said, it is necessary to be able to draft any kind of contract, to attend courses and much more.

Looking for Italian Social Security Number?

The Italian Fiscal code is also similar to the “social security number” given that it necessary to use the Italian Medical System.

Are you looking for codice fiscale?

If you want to have in a simple and quick way your fiscal code in Italy please go to the following link fiscalcode.italylawfirms.com – those guys are expert in legal services and can help you having the fiscal card.

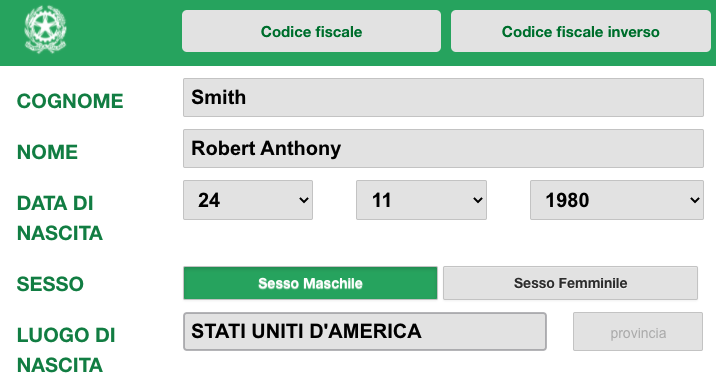

Codice fiscale example

The legislation governing the method to calculate the fiscal code is the decree of the Ministry of Finance of 23 December 1976, (‘Systems for codifying the persons to be entered in the tax register’).

For natural persons, the fiscal code is composed of sixteen alphanumeric characters;

For legal persons, such as companies or bodies, it is instead an eleven-digit number (8 for recognized associations, 9 for those not recognized).

How is the social security number calculated?

The personal fiscal code/ security number consists of sixteen alphanumeric characters:

- Surname (three letters)

- Name (three letters)

- Date of birth and gender (five alphanumeric characters)

- Common (or State) of birth (four alphanumeric characters)

- Check character (one letter)

–> Want to know more about studying and Visa documents in Italy?

How to get a codice fiscale online

Apparently there are many ways to ask for a Codice Fiscale online, but it’s not easy if you are not in Italy.

Visiting the Italylawfirms’ website the best way to get a Codice Fiscale (Italian tax identification number) online. Once there, you just need:

- To have some personal information ready, such as your full name, date of birth, and place of birth, in order to complete the application.

- If you are from outside Europe, you’ll need a Visa, a temporary residency permit: contact the Italian embassy or consulate in your country – if the embassy or consulate is able to process your request, they will provide your permit.

Is the fiscal code I get for free online valid?

No, absolutely not. You can calculate your codice fiscale by yourself but this operation is useless, because the related alphanumeric string will be not valid. So, even if you’ll find many online tools using the specific algorithm used to generate the codice fiscale manually, please do not lose time there. There are two major problems regarding auto-generated Italian tax-codes:

- By calculating it on your own you can have homocody – two different people with identical Tax Code;

- The code is valid only when it is assigned and registered by the competent authority